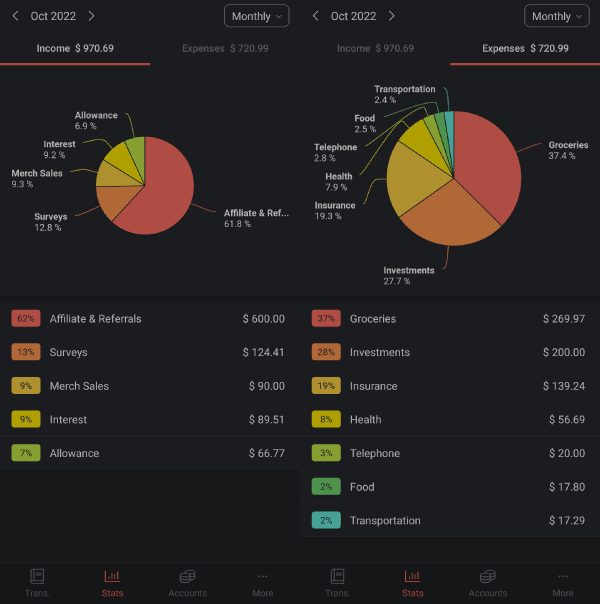

Here are my monthly financials for October 2022.

Top 3 Income Sources

Affiliate & Referrals – S$600

Although the number of referrals dropped but it is still higher than expected.

This month’s referral is actually S$645 but for easy calculation’s sake, I will shift S$45 to November.

If you still have not signed up for a Trust Bank account, you can check out how to get the sign-up rewards here.

Surveys – S$124.41

This is from me cashing out my points from Rakuten Insight Surveys and ApiaryBuzz.

Merch Sales – S$90

I received US$63.25 worth of commissions from selling merch on TeePublic and Redbubble. If you like to find out more about selling merch, you can look at an article I wrote here.

Top 3 Expense Sources

Groceries – S$269.97

This is from buying groceries. Since I have the NTUC vouchers, the weightage of grocery buying fell more onto me or else I might have trouble finishing using the vouchers by their expiry date.

Investment – S$200

S$200 of it is my monthly DCA into STI ETF using POSB Invest-saver.

Insurance – S$139.24

This month I paid for my integrated shield plan from Great Eastern. This also includes a S$6.24 payment for Aviva’s term life and personal accident insurance.

CLL’s Infrequently Curated Videos

Buy Now, Pay Later: Echoes of the 2008 Recession

Buy Now, Pay Later services are gaining popularity. They provide credit to those that are unable to apply for credit cards. In 2020, BNPL accounted for US$97 Billion of global online sales. 3 major players in the US have 173 million users around the world. 4 in 5 Americans use BNPL services. BNPL services promote irresponsible spending and overconsumption. Users can easily gain credit with some clicks on the app, increasing the spending power within seconds. Smaller payments also make a bigger purchase seems reasonable. And if you can send those payments to a credit card, you can spread the payments over a longer period of time.

There is an arms race to sign up as many exclusive merchants as possible. The more attractive and exclusive the merchants on their platform, the more users will sign up, the more consumers are tempted to take buy more, the more users opt for longer loans that has interest, the more money the companies make.

Main Revenue Sources

They claim to not charge interest so how do they make money? Here is a breakdown of their revenue streams

- Interest Income (main source – revenue from non-default longer (e.g. up to 60 months) BNPL plans)

- Late Fees (revenue from late payment fees)

- Merchant Fees (commissions from merchants using BNPL, which is similar to credit cards)

- Virtual Card Fees (revenue from being a card issuer, they get a slice of the pie of the credit card fees)

- Loan Sales (revenue from selling away loans to third parties to reduce risk)

- Servicing Fees (revenue from serving the loans sold)

Despite claiming not to charge interest, they have interest-charging plans that drag over a longer period of time and interest income is their top revenue stream. The payments are split into such small amounts, some consumers do not mind paying interest (up to 40%!). This makes it similar to credit card minimum payments. Although they encourage consumers to spend more and more, these companies are not profitable, similar to many fintech companies nowadays.

The loan sales are also scarily similar to the 2008 subprime mortgage crisis where loans are given out indiscriminately and then packaged and sold to investors. When consumers default on these loans en masse during a recession, it could create another crisis within the recession crisis.

Fortunately, the iterations of BNPL in Singapore have some limitations like only one purchase and limiting fees. There is a Buy Now, Pay Later Code of Conduct that companies in Singapore are expected to follow and will take effect on 1 November 2022. We will see if these Singapore BNPL companies can thrive without the predatory behaviours of their western counterparts.

What the Hell Just Happened in the UK? Pounds, Pensions & Panic

Earlier in the month, we did not have to make currency conversions for these 3 currencies as 1 USD = 1 GBP = 1 EUR. The GBP crashed about 35% while the 10-year UK treasury bond crashed 40% due to the announcements of tax cuts by the ex-finance minister. The market thinks that the tax cuts are not sustainable and will require the nation to take on more debt to finance its nation’s programmes. Interest rates are rising so increasing debt means paying even more interest. This led to investors selling off the 10-year bonds as the yield is no longer attractive, leading to the price falling.

Pension funds are also trying to sell away their bonds to cut their losses which further pushes down the prices. There are not enough buyers in the market which led to some pension funds being unable to sell away their bonds to meet their margin requirements, leading to some of them nearly failing. The Bank of England will commit to buying back bonds to prop up prices but we are not sure how much can they help.

China’s Housing Crisis is Getting Much Worse

When you thought it couldn’t get worse, it actually did. Due to the Evergrande contagion, home sales have declined and consumer confidence is at a low. Remember that the housing market on its whole makes up 30% of China’s GDP. Local provinces also rely a lot on land sales as income for their programmes and when properties are not being built, their revenues are essentially cut off. Some provinces removed homebuying curbs to try to bring back their income but were instructed to reinstate them 24 hours later as instructed by Beijing. Local governments need this income for survival while the national government feels that home prices are unsustainable, leading to a dilemma. Not mentioned in the video but also relevant, consumers are refusing to service their loans as their homes are not being built, leading to another crisis.

Budget Challenge: One Pound, One day, 3 Meals (Limited Foraging)

This content creator has a series of videos showing him trying to feed himself at extremely low budgets with certain limitations. Due to high inflation, he wants to see if this challenge is still doable. He was able to purchase some pork trimmings as a protein source in his previous challenges but now, he is only able to purchase peas. He visits a supermarket and purchases what he can and attempts to create dishes out of them. Some are disastrous while some are acceptable. It is very entertaining to watch.

Credit Suisse – 2022’s Latest ‘Lehman Brothers Moment’

People are calling for a Lehman Brothers-style collapse for Credit Suisse but this content creator disagrees. Although Credit Suisse is in quite deep shit, they are still doing relatively well as compared to Lehman Brothers. Of course, this is dependent on the validity of their financial numbers which can be quite iffy looking at the reputation of Credit Suisse.

Can You Monetize Meditation Channels on Youtube?

I came across a YouTube video randomly saying that we can make tens of thousands of dollars a month by uploading free music. Some of you might search for relaxing music for studying, working or even sleeping and will see some of the top videos have millions of views. Using their software for analysing social media, these financial gurus say that these channels generate a lot of passive income by doing something that is essentially cost-free. I was intrigued so I looked into it. This content creator tested out uploading 10-hour videos but he only received minimal views. You will not only need 1,000 subscribers to start making money on YouTube, but you will also need 4,000 watch hours over the past year before you can apply to YouTube’s partner program.

First, the market is extremely saturated with new players having an extremely low chance of beating the already well-established channels. Secondly, YouTube has demonetized some of these videos as they do not think that these videos bring value to the platform. These videos are also listened to instead of watched so advertisers wouldn’t want to pay for video ads in these meditation-style music videos.

Why is Pasta from a restaurant so much better than homemade?

Ever wondered why your pasta tastes so meh while the ones you eat at a restaurant taste so much better? This content creator breaks down the reason into 6 main concepts.

- Layering salt (getting your saltiness from the noodle, sauce and toppings)

- Layering fat (fat brings flavour and texture. Fat can be added in aromatic bases, sauces and toppings)

- Sauce consistency (it needs to cling onto the pasta so you can taste the pasta and sauce together)

- Right Pasta (Teflon cut vs bronze cut. The latter is rougher, allowing the sauce to cling and releasing more starches to make a creamier sauce)

- Ingredient Quality (self-explanatory)

- Plating (Possibly the least important as you can’t make a bad-tasting pasta taste good via plating but plating can maybe add a few points to make a dish more enjoyable)

Beer at 90 Yen at Tenma, Osaka Japan.

We have the impression that Japan’s food is expensive but this video shows that we can get cheap delicious food and alcohol at unbelievable prices. This video is in mandarin so I will summarize some of the points. These shops only have Japanese menus so you need some basic Japanese to order. Even if you know Japanese, hand-written menus can be very hard to understand too. However, if you do your homework before going down to these Izakayas, you will be in for a treat.

They have happy hours between lunch and dinner where you can get skewers for as low as 50 Yen (S$0.50), Sashimi (5 slices) for 190 yen (S$1.90), Tempura for 110 and 220 Yen (S$1.10 – S$2.20) and a glass of beer for S$0.90. There is even a 75-minute alcohol buffet for 550 Yen (S$5.50) where you can drink unlimited self-served Highball (soda water and whiskey) and lemon sour (shochu, soda water and lemon juice) direct from the tap.

Money Manager App

I am using an app called Money Manager to track my income and expenses. It is a free tool available on mobile available on Google Play Store and Apple App Store.

As far as I know, the data collected from the app is for tracking the ads you view and interact with on the app.

Please check out their privacy policy on what information they collect and what is it used for.

Personally, the value this app brings to me outweighs the value of the information I provide to them.